can you go to jail for not paying taxes uk

In fact even an audit is highly unlikely to land you in jail. Jail for not paying is a real possibility.

Income Taxes The Key Word Is Income Accounting Humor Income Tax Humor Taxes Humor

Crown Court cases can be a maximum of seven years in prison or an unlimited fine.

. If you are worried about. For most people it disrupts their income sometimes completely. An evasion of income tax can result in an automatic prison sentence of seven years or a fine of up to 30000 if your offence is committed in Britain.

Fines for tax evasion are usually heavy in the UK and jail time for offenders is possible if you are caught red-handed. The short answer is maybe. You cannot go to jail for not being able to pay but you can go to jail for ignoring the court.

HMRC estimates that 93 of tax due is paid and this is largely due to the fact that most people are taxed at source the correct sums are paid at the correct time automatically usually out of wages. Whether a person would actually go to jail for not paying their taxes depends upon all the details of their individual tax circumstances. Yes you can be sent to prison for not paying tax.

There will be fines involved in tax evasion and in the UK the maximum punishment is typically jail time. It depends on the situation. The short answer is maybe.

Ella Byworth But its important to remember that no prison sentence will ever be because of. About 30 people a year go to prison for not having a TV licence although new sentencing guidelines in 2017 should. You cannot go to prison for being in debt Picture.

You can go to jail for lying on your tax return. About a hundred people a year are sent to prison for council tax arrears here is a case where a mother was in prison for 40 days before being released. For these people the answer to Can you go to jail for not paying taxes is No The IRS is in the business of collecting revenue rather than trying to punish people who make mistakes.

The maximum penalty for income tax evasion in the UK is seven years in prison or an unlimited fine. However you cant go to jail for not having enough money to pay your taxes. Making an honest mistake on.

You can go to jail for not filing your taxes. The United States doesnt just throw people into jail because they cant afford to pay their taxes. Being behind bars prevents most people from being able to take care of the daily necessary chores we take for granted.

Providing false documentation to HMRC either magistrates court or as a summary conviction HMRC tax evasion penalties can range from a fine of up to 20000 or up to 6 months in prison. Unfortunately it is the threat of being sent to prison that some bailiffs rely upon to get a debt paid. Sometimes people make errors on their tax returns or are negligent in filing but they are not intentionally trying to avoid paying taxes.

Where tax evasion does occur however it is dealt with. If you have been charged with criminal fines there isnt a way for you to avoid them. Generally speaking tax evasion is not a common problem.

To better understand these distinctions take a closer look at when you risk jail time for failing to pay your taxes. If youre not in a position to pay the sum due you have two options. However you can face jail time if you commit tax evasion tax fraud or do.

However you cant go to jail for not having enough money to pay your taxes. The maximum penalty for income tax evasion in the UK is seven years in prison or an unlimited fine. Where over a period of time an offender has evaded tax they must not only pay the tax and pay a financial penalty but a custodial sentence should also be imposed.

It rarely happens but its important to know the sorts of debt where this is a possibility. However Regulation 47 states that imprisonment should only be considered when the offender wilfully neglects the debt or willfully refuses. What Happens If You Get Caught Not Paying Taxes Uk.

Getting into difficulties leading to a jail sentence can be tough. So ultimately can you go to prison for not paying council tax. The effort made to conceal the fraud.

England remains the only part of the UK where individuals can be sent to prison for not paying local tax bills. Can You Go To Prison For Not Paying Taxes Uk. So they allow you to file corrections and explain anomalies.

In very rare cases of wilful refusal or culpable neglect a person can be sent to prison for not paying their council tax. Can you go to jail for not paying council tax. The short answer to the question of whether you can go to jail for not paying taxes is yes.

Can you go to jail for not paying tax UK. Tax evasion penalties apply when its a summary conviction and is carried out within 6 months or if its a fine the length of the jail term plus the fine. If you dont pay the debt as well you can be taken to jail as it is considered a criminal offence.

Evasion of VAT in the magistrates court the maximum sentence is 6 months in jail or a fine of up to 20000. Yes you can go to prison for not paying taxes or filing your tax returns but the circumstances have to be pretty extreme for that to happen. The short answer to the question of whether you can go to jail for not paying taxes is yes.

This can put you in jail for one year per year that you failed to pay. VAT evasion can result in a maximum jail term of six months in jail or a fine of up to 30000 if the offense is committed in the A Crown Court sentence can reach up to. The length of the sentence will depend on a number of factors including.

Yes you can be sent to prison for not paying tax. Cheating public revenue due to the serious nature of the crime the maximum. What Happens to Your Debt When You Go to Jail.

The amount of tax evaded. The Local Government Finance Act 1992 states that people can be sent to prison for up to 90 days for council tax debts. Paying any bills while in jail is extremely.

The period of time during which the evasion took place.

Tax Time 2015 Why Tax Cheats In Canada Are Rarely Jailed Cbc News

Tax Time 2015 Why Tax Cheats In Canada Are Rarely Jailed Cbc News

Government You Owe Us Money It S Called Taxes Me How Much Do I Owe Gov T You Have To Figure That Out Me Ijust Pay What I Want Gov T Oh No We Know

Todd And Julie Chrisley Convicted On Fraud And Tax Evasion Charges People Com

Debtors Prison The Council Can Lock You Up If You Don T Pay Your Bills The Independent The Independent

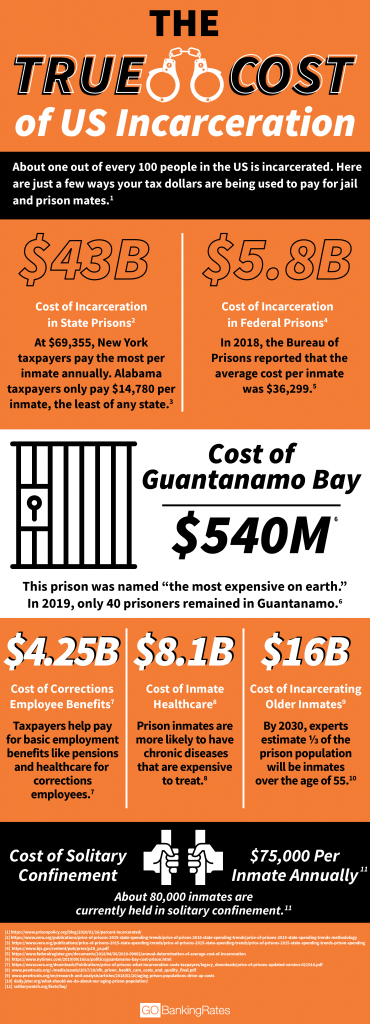

How Much Tax Dollars Are Spent On Prisons In America By Valerie Jenness Medium

The Woman Jailed For A 4 742 Council Tax Debt She Could Not Pay Council Tax The Guardian

Pin By Be Love On Joe Rogan Quotes Life Captions Tax Quote Joe Rogan

Lauryn Hill Jailed For Tax Evasion Bbc News

Steam Atolyesi Monopoly London Uk Monopoly Monopoly Cards Monopoly Board

Monopoly Monopoly Cards Comic Book Girl Monopoly

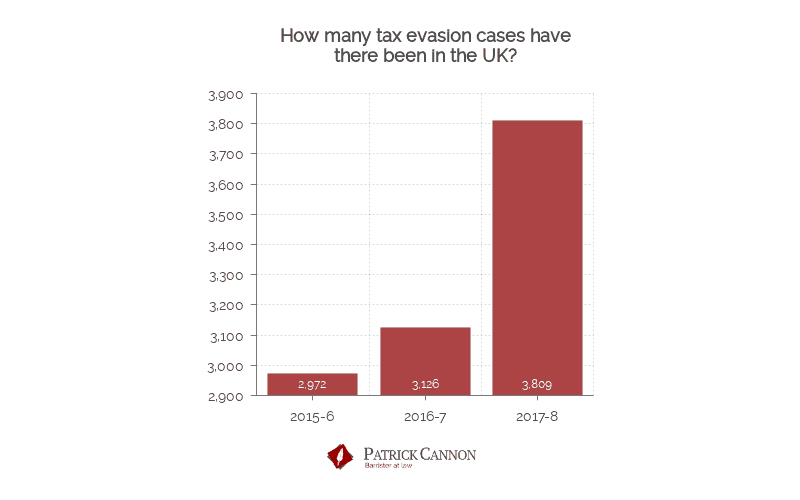

Tax Evasion Statistics 2020 Uk Tax Evasion Facts Patrick Cannon

Tax Evasion Leads To Prison Time House Arrest 400k Fines For Arkansas Business Owner

Who Goes To Prison For Tax Evasion H R Block

Infamous Tax Crimes Turbotax Tax Tips Videos

How Much Do Taxpayers Pay For Prisoners Gobankingrates

Average Jail Time For Tax Evasion Convictions Prison

Wesley Snipes Who Was Jailed For Failure To File Taxes Claims Trump Avoided Tax Because Of Who He Knows The Independent